How Do I Register A Money Transmitting Business

The coin service business industry has undergone rapid alter and transformation as technology has evolved over the by decade. The emergence of digital currencies (too called cryptocurrency) has necessitated the germination of laws addressing this culling form of payment. The prevalence of coin laundering has required stricter state legislation and regulation of money service businesses throughout the country. Specifically, the money transmitter manufacture is having to adjust on the fly to these new regulations. Currently, 49 of the 50 states crave coin transmitters to file a surety bond. Montana is the only state that has not created a surety bond requirement for coin transmitters. Nosotros at SuretyBonds.com have created this a quick guide to outline the current land of the money transmitter industry and detail some of its licensing requirements.

What is a money transmitter?

Likewise referred to as money remitters or money transfer services, coin transmitters transfer funds or provide payment services. Nearly states define anyone who receives money to transmit money to another location past any means, including wire, facsimile, electronic transfer or payment instrument, as a money transmitter. Money transmitters are one of several disciplines within coin services businesses (MSB), which describes businesses that catechumen or wire money. Although the majority of money services business organization disciplines require a minimum threshold to be considered an MSB, a threshold does not exist for money transmitters. Therefore, whatever business that transfers funds or provides payment services is considered a money transmitter regardless of business organization activity. Some examples of money transmitters include Barclays, PayPal, Western Spousal relationship and MoneyCorp.

Acquire more about Money Transmitter License Bonds here.

What are the licensing requirements?

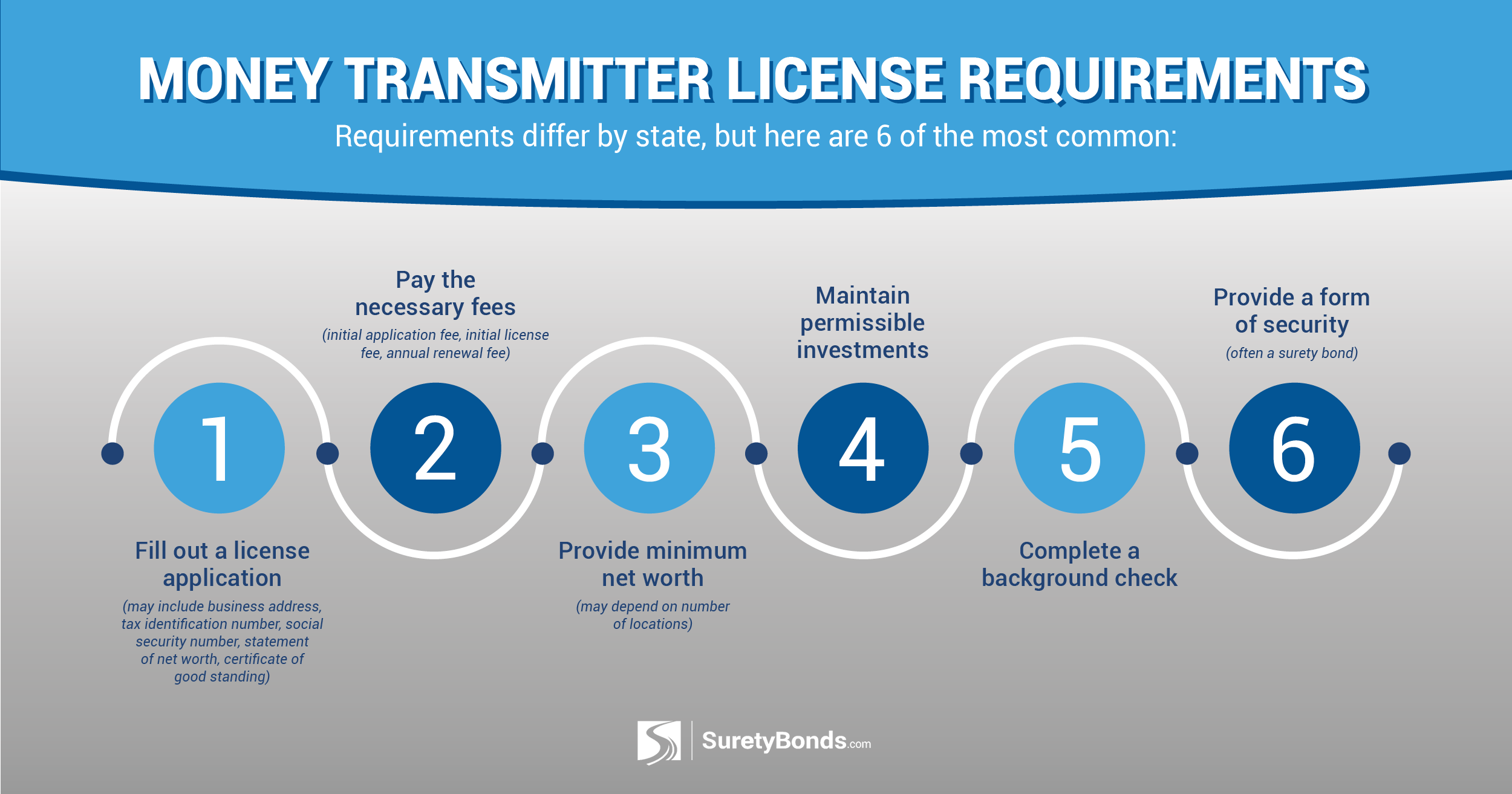

Because every state has its own licensing requirements, at that place is considerable variability in money transmitter requirements from state to country. Nonetheless, every state too Montana requires transmitters to satisfy requirements to exist licensed as a coin transmitter. It is important for money transmitters to be familiar with the licensing requirements in every state in which they practise business. Despite the variability, common requirements for money transmitters include the following:

- License application (which may include business address, tax identification number, social security number, statement of net worth, document of proficient standing, etc.)

- Payment of fees (initial application fee, initial license fee, annual license renewal fee)

- Minimum internet worth (could depend on number of locations)

- Maintenance of permissible investments

- Background check

- Grade of security (unremarkably a surety bond)

About bond requirements have a minimum and maximum amount specified in the state's legislation. For each location within the state, there is ofttimes a smaller additional amount. The commissioner or superintendent of the state's department of financial institutions will likely determine the amount of the applicant's bond based on a number of factors:

- Applicant'south financial status

- Applicant'due south net worth

- Amount of business for the previous year

- Anticipated business organization for the upcoming year

In addition to the various state requirements, money transmitters must also annals with the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of Treasury. Registration is valid for 2 years before it must be renewed. Money transmitters must utilize the BSA Eastward-Filing System to submit initial registration forms and renewals. As of July 1, 2012, FinCEN no longer accepts newspaper forms. At that place are civil and criminal penalties for money services businesses that practice not register with FinCEN.

You lot tin notice instructions for how to enroll and submit your registration form in the BSA E-Filing System here. Section 1022.380, Title 31 of the Electronic Code of Federal Regulations details the registration requirements for money services businesses with FinCEN.

If you are curious virtually a specific state's licensing requirements, a comprehensive list of all state requirements pertaining to coin transmitters can be institute hither.

Get a Free Money Transmitter Bond Quote

For a visualization of the licensing procedure, run across the graphic below.

What dilemmas are the money transmitter industry facing?

As mentioned higher up, 49 of the l states require money transmitters to secure a surety bond earlier they can receive canonical licenses. These land requirements are layered on top of federal registration requirements with FinCEN. In addition, coin transmitters must exist licensed in every land in which money manual activity takes identify. For example, if a coin transmitter has a principal location in California simply conducts money manual business organization in 37 other states, the transmitter must be bonded in all 37 states in addition to California. As a result, licensing for money transmitters in the U.S. can exist very expensive.

Recent enquiry estimated the initial licensing toll for money transmitters for all 53 states and territories to be just over $175,000, with renewal costs of slightly more $135,000. High costs and varying requirements by country is widely considered past individuals working in the manufacture to be an inefficient system of regulations. It remains to exist seen if FinCEN creates a compatible set of licensing requirements for coin transmitters to diffuse defoliation, potentially lower costs and streamline the licensing process.

Some other issue facing the money transmitter industry revolves around who qualifies equally a money transmitter and therefore must register and see licensing requirements. With emerging engineering science constantly creating new classifications of businesses, the MSB industry must adjust its standards on a regular basis. In 2014, FinCEN ruled that bitcoin exchanges and payment processors are coin transmitters nether U.S. law. Bitcoin exchanges involve matching buyers and sellers, while processors facilitate purchases between consumers and merchants. This ruling is worrying to some, equally there may exist few limits to the scope of the MSB (specifically money transmitter) definition. Every bit technologies go on to evolve and the telescopic of the MSB industry is tested, it will be interesting to see what businesses are lumped into the MSB category and must comply with the heavy licensing and registration requirements.

For more data, bank check out our Guide to Money Transmitter License Bonds here.

How Do I Register A Money Transmitting Business,

Source: https://www.suretybonds.com/blog/the-quick-guide-to-money-transmitter-licenses/

Posted by: keaneycounale.blogspot.com

0 Response to "How Do I Register A Money Transmitting Business"

Post a Comment